Investment

The Nextec Growth Fund is an Australian managed investment fund that provides investors with a convenient and reliable method of demonstrating compliance with SIV requirements to invest in early stage Australian companies.

The fund gives investors access to a diversified portfolio of growth-stage businesses that have been carefully selected on the basis of quality of entrepreneurial management, market potential and pragmatic growth strategies

The Nextec team have been active participants in the early stage company sector for over 20 years as investors, operational entrepreneurs and corporate advisors specialising in mergers and acquisitions, growth strategies and capital raising in Australia, South East Asia and the USA.

Our team is complemented by an extensive network of industry professionals whose domain expertise in our target investment sectors and early-stage investing brings added depth and expertise.

The fund gives investors access to a diversified portfolio of growth-stage businesses that have been carefully selected on the basis of quality of entrepreneurial management, market potential and pragmatic growth strategies

The Nextec team have been active participants in the early stage company sector for over 20 years as investors, operational entrepreneurs and corporate advisors specialising in mergers and acquisitions, growth strategies and capital raising in Australia, South East Asia and the USA.

Our team is complemented by an extensive network of industry professionals whose domain expertise in our target investment sectors and early-stage investing brings added depth and expertise.

Investing Profile

The fund will invest in businesses which demonstrate some of the following characteristics:

- a track record of rapid growth

- a management team with solid domain and early stage experience

- intellectual property or other asset which provides competitive advantage

- are participants in a technology related sector

- have an enterprise value under $50 million

- require investment of between $1 million and $ 5 million from the Fund

- are capable of achieving a saleable enterprise with less than $15 million in investment capital

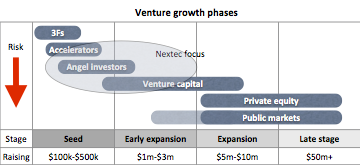

Business Stage for Investment

Risk Management

The investment strategy for the fund seeks to offset the risks inherent in early stage businesses by targeting opportunities with demonstrated customer support, a competitive differentiation and a large market opportunity.

SIV Compliance

The requirements of the SIV investment guidelines and the legislated requirements for an ESVCLP mean that certain exclusions and limitations will apply to investments by the fund.

The fund will not invest in:

The fund will not invest in:

- an entity which has total assets in excess of $50 million;

- any business listed on a stock exchange;

- a business which is not structured either as a company or as a unit trust;

- a business that seeks to invest NGF8A’s investment into another entity;

- derivatives other than for hedging purposes or where the investment into venture capital is structured as a derivative (e.g. options)